# Not all numbers are the same

With companies releasing their second-quarter earnings, a flurry of articles on the e-commerce market has emerged. The struggles of traditional powerhouses, the surge of Coupang and Naver, and the reversal of Kurly. These are the general summaries.

The problem lies in the numbers. Each company only presents favorable indicators, making interpretation difficult. It’s hard to believe whether Lotte, Shinsegae, Gmarket, and 11st are truly struggling, whether Coupang and Naver are growing without a hitch, and whether Kurly’s report card is trustworthy.

So, when looking at performance, we need a standard.

design by 슝슝 (w/ChatGPT)

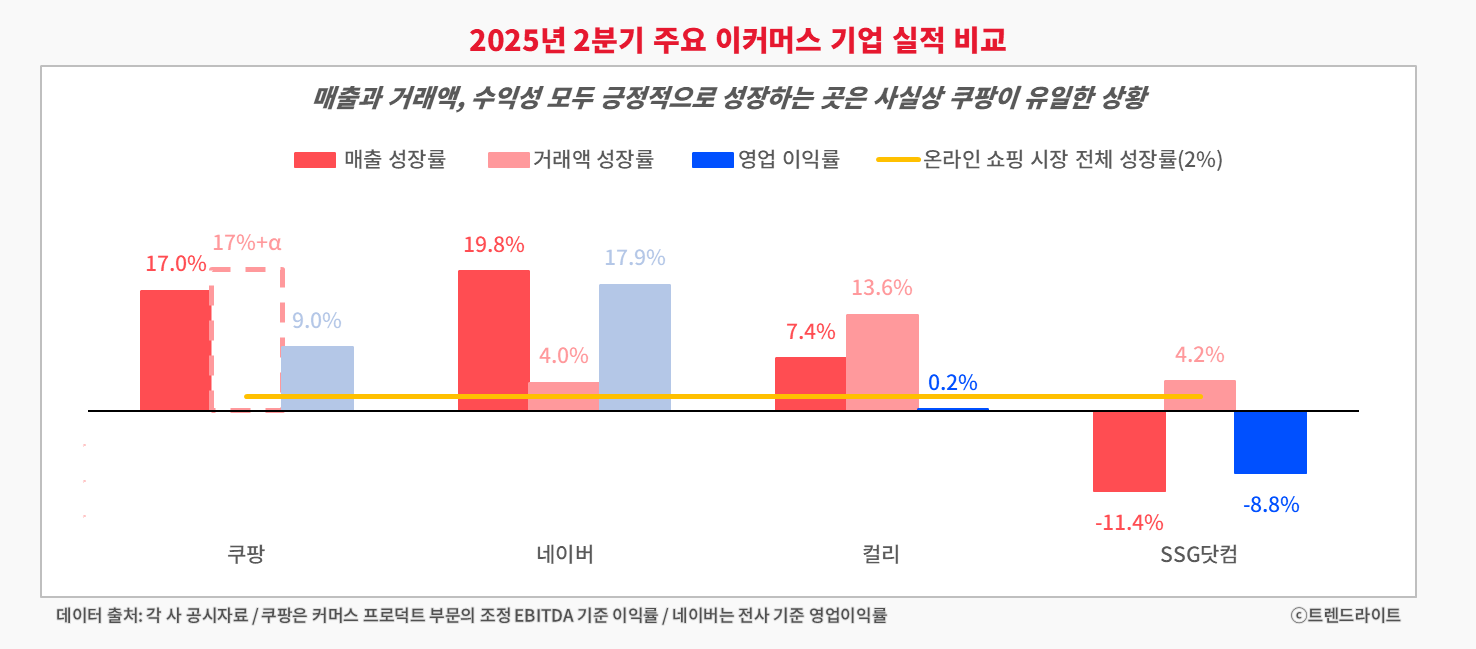

First, consider the relative growth rate compared to the market. According to Statistics Korea, the e-commerce market growth rate in the first half of this year was only about 2%. This means the market is practically at a standstill. Anything above this figure is considered a positive performance, while anything below it is considered a slump. In this context, even a slight increase in sales should be considered a positive development.

Second, profitability. The “e-commerce = deficit” formula has been broken since Coupang’s turnaround. With the investment market frozen, the “planned deficit” model no longer works. Now, the key is whether growth and profitability can improve simultaneously. We’ve entered an era where one or the other is no longer sufficient.

Third, GMV (general merchandise value). While the “uselessness of GMV” theory was once raised, it remains a key indicator for assessing long-term performance. In particular, if transaction volume stagnates while sales increase, it could be a short-term performance overstatement. This approach is unlikely to last, and its limitations will eventually become apparent.

# Changed standards, new interpretations

Based on the three criteria mentioned above, Coupang achieved the best performance. It achieved significant results in all three categories. Sales in its core product commerce division grew 17% at constant exchange rates, outpacing the market average of 2%. Profitability also improved.

Moreover, transaction volume appears to have grown beyond sales. In the past, Coupang focused on direct purchases, to the point where “Rocket Delivery sales = transaction volume,” but recently, it has been rapidly increasing its presence through marketplaces. Therefore, the 17% sales growth rate may underestimate actual transaction volume growth. Even at this moment, Coupang’s dominance is growing stronger.

Naver’s situation is different. While its sales growth rate surpassed Coupang’s at 19.8%, its transaction amount growth rate was only 4%. Looking solely at its own “on-platform” channels, such as Smart Store and Brand Store, growth was 9%. This represents a shift within internal channels, but the overall platform power is weakening. The sustainability of its growth model, which relies on advertising and commission increases, is increasingly questionable. Therefore, while its performance appears excellent on the surface, internal concerns are likely deepening.

Kurly showed a marked rebound in its first-half performance. While sales growth was modest at 7.4%, transaction volume increased by 13.6%, outpacing Naver OnPlatform. As evidenced by the more than doubling of commission revenue year-over-year, its marketplace expansion strategy proved effective. Product sales also grew by 6.7%, outperforming the market average.

Above all, it’s noteworthy that Kurly achieved both growth and profitability by recording its first half-year profit. Oasis, with which it’s often compared, saw its sales increase by 9.2% during the same period, reaching a record high, but its operating profit actually declined. This highlights Kurly’s rebound. Of course, it’s important to remember that Kurly still has much to prove, having just reached the break-even point.

Finally, the traditional powerhouses (Gmarket, 11st, SSG.com, and Lotte On) are struggling by any standard. Sales are declining, and profitability is also deteriorating. While the decline in direct purchasing is likely partly due to this decline, it’s undeniable that their transaction volume and presence are rapidly declining, as evidenced by traffic and other indicators. While they’re separating logistics to improve profitability, they’re also trapped in a vicious cycle where their competitiveness is weakening in the process.

# Everyone emphasizes overseas

To sum up, Coupang was the only company that clearly enjoyed a brighter first-half performance. Kurly is barely managing to catch its breath, Naver is sacrificing its future for its current performance, and other players are facing a precarious situation where their very survival is at stake.

This difference stems from investment pressure. While companies received large investments during booming markets and grew their size, they are now facing the consequences. This obsession with short-term results has sapped the capacity to develop mid- to long-term strategies.

Coupang is an exception here. Having gone public during a boom, it was relatively free from investor pressure. Furthermore, with founder Kim Beom-seok holding the decision-making power, the company is structured to bet on the future rather than the stock price. Indeed, despite criticism of slowing profitability, Coupang is actually increasing its overseas investments, expanding its Taiwanese operations and preparing to re-enter the Japanese market.

The problem is that this structure isn’t easily changed. They must simultaneously maintain profitability while demonstrating growth potential and corporate value. However, Coupang’s already solidified dominance in the domestic market alone makes it difficult to meet these expectations. Even Coupang recognizes its limitations.

Accordingly, major companies are all turning their attention to overseas markets, emphasizing this in their earnings reports. Musinsa, for example, has chosen Japan and China, Kurly the US, and Coupang Taiwan and Japan. Overseas strategies have become a key variable determining the success or failure of e-commerce companies. We will continue to monitor this trend and keep you updated.

( * This article is content published in the newsletter ‘Trendlight’ by the bizarre writer. )

The Odd Writer

We’re creating the newsletter “Trendlight.” Trendlight is Korea’s largest vertical commerce newsletter, covering “everything related to buying and selling.” Every Wednesday morning, we curate the freshest trends and deliver them to your inbox, along with practical insights from industry experts. brunch.co.kr/@trendlite